Abound Credit Union creates possibilities for your financial future in Kentucky and beyond.

Free. And oh-so-easy.

Your Free Checking gives you access to helpful money management tools like a Free Visa® Debit Card, Online and Mobile Banking and more, all while having no fees.

Time works for you.

Your Certificate Account provides higher interest rates than most traditional savings accounts. The longer your term, the higher your return.

Plan it. Build it. Love it.

We make getting your home as hassle-free as possible with financing options for every situation.

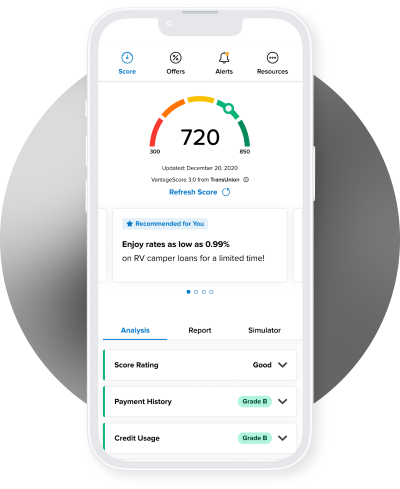

Staying on top of your credit has never been easier

Access your credit score, credit monitoring and more with Savvy Money!**

Financial wellness in every direction.

Your financial tips, all in one place.

Read our Blog

The confidence needed to make your next financial move.

Try our Calculators

Banking is only the beginning.

Your financial journey starts here.

Improving the lives of Kentuckians, everyday.

$1,720,418

Fees saved by Members in the past year.*

$18,948,795

Saved by Members on Loans in the past year.*

$39,850,561

Total savings to Members in the past year.*

11,467

Students receiving Financial Education from Abound.

Start your learning journey.

We help our communities learn financial responsibility.

Have Questions?

We help you find answers.