Calculators

We offer financing to help cover your plans.

Run the numbers with these calculators and be confident to make your next financial move

Abound is here for the big decisions! These instant calculators help you know what you can afford. Whether you're planning for retirement, looking into Mortgage or Auto Loan options, these calculators help you set a budget and manage debt.

Compare Your Rates and Save

Compare average rates across Kentucky and see how much you could save with us.

Calculate an Auto Loan Payment

Quickly compute the total cost of the vehicle you have your eyes on to see what your monthly payments might be.

Compare Auto Loan Payment Options

Whether you're looking for a lower monthly payment to save cash or a shorter term to pay your loan off sooner, we have options!

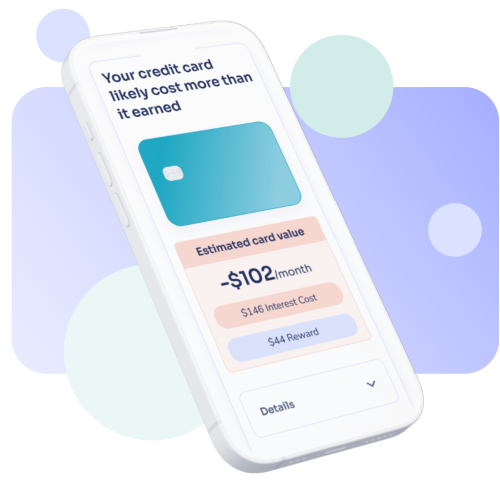

Card Check Tool

Find out what your current credit cards are costing you and how much you could save with Abound by using this free Card Check tool.

Compare Two Auto Loans

Calculate details to learn which option could fit your budget.

Calculate a Home Loan Payment

There's more to a monthly Mortgage payment than the cost of your home. Consider various costs to help calculate your payment.

Rent Or Buy

Consider all the costs to determine which option is best for how you want to live your life.

Refinance Your Home Loan

Refinancing your Mortgage could lead to big savings monthly or over the life of your Home Loan.

Save for College

Create a college savings plan or fine-tune your existing one to make sure you're on track.

Save Toward a Goal

Create a savings plan and see what it takes to reach it.

Debt Consolidation

Combine several loans into one to see how much you could save.

How Long Could It Take to Pay Off a Credit Card

Take a deep breath and gain control while creating a plan to pay down your debt.

Balance Your Checkbook

Figure out where your money goes so you can create a plan to save more of it.

How Much Am I Spending

Figure out where your money goes so you can create a plan to save more of it.

Abound Credit Union is a full-service financial institution with locations throughout central and southern Kentucky.

Banking is only the beginning.

Have Questions?

We help you find answers.