Classic Credit Card

Your renovation project needs met.

Buy what you need. And save as you go.

Here's the perfect shopping companion. With consumer-friendly rates, the Abound Classic Visa® trims your overall interest charges and helps keep monthly payments under control.

Pro tip: To save serious money, transfer balances from your higher rate credit cards to the Classic Visa. There's no balance transfer fee - and there's plenty to be gained by paying a lower interest rate on all your credit card debt.

This Classic comes with some nice perks

Qualify for credit limits of up to $35,000

Lower rates, no annual fee and no balance transfer fees keep your finances on track.

Free Visa Identity Theft Monitoring through NortonLifeLock™.

Free travel insurance through Visa.

Meet your budget's new best friend

- Low interest rates

- No balance transfer fees

- Low cash advance fees

- Free Visa Identity Theft Monitoring through NortonLifeLock™

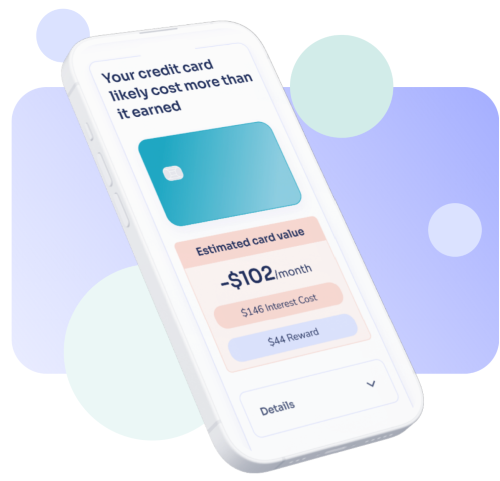

Find out what your current credit cards are costing you and how much you could save with Abound by using this free Card Check tool.

Abound Credit Union is a full-service financial institution with locations throughout central and southern Kentucky.

Classic is always in style

Your card can be used in a way that works for you, whether it's contactless, in person or online.

Have Questions?

We help you find answers.