Certificate Account

We make getting your home as hassle-free as possible.

Who knew your time was worth so much?

Over the next few months or years, you'll eat, sleep, work and play. With a Certificate account, you can earn money at higher rates for simply going about your life. Do you need to do anything else? No, it's that easy.

Set your own saving schedule

With our Certificates, you can save anywhere from three months to five years. Typically, the longer term of your Certificate, the higher rate of return.

Certificates feature higher dividend rates than most traditional savings accounts.

We've got you. Your funds are federally insured up to $250,000.

The good news is your Certificate rate is locked in

The economy dips and swerves. The markets rise and fall. What's that mean for your Certificate earnings? Nothing at all. That high rate you signed up for on day one will never change during the term of your Certificate. You can predict down to the last dollar how much you'll end up with - making this saving strategy one of life's few sure things.

- Higher rates accelerate your savings efforts

- Choice of Certificate maturity dates means you can align your saving strategy with your future plans

- Safe, secure investment with no risk to your initial deposit. (However, you may forfeit dividend earnings if you withdraw funds before the Certificate maturity date)

- Certificate deposits insured by the National Credit Union Administration

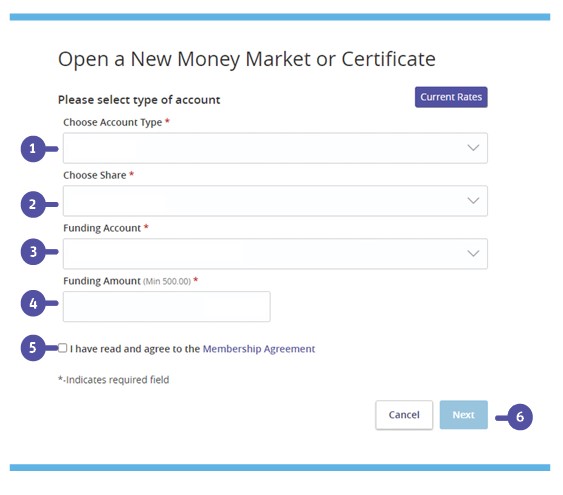

Log into Mobile or Online Banking and under the Menu in the Apply & Open tab, click Certificates & More

- Use the drop-down to select an Account Type

- Use the drop-down to select a Share Type

- Use the drop-down to select a Funding Account

- Enter the Funding Amount (Minimum $500.00)

- Review and accept the Membership Agreement

- Click Next

- Verify the information and click the Submit button when you are finished

Give us a call at 800.285.5669 or visit your local branch for a Team Member to help establish a Certificate for you.

Establishing Membership is easy! Start the process here!

Abound Credit Union is a full-service financial institution with locations throughout central and southern Kentucky.

Boost your savings with a Certificate

We help you finance your dream car through a low rate and flexible term loan.

Have Questions?

We help you find answers.

*See Rates page by clicking the link for details